Navigating Compliance Requirements for Singapore Companies

Welcome to our guide on navigating compliance requirements for Singapore companies. As a Singapore-incorporated company, it is crucial to adhere to the Accounting and Corporate Regulatory Authority’s (ACRA) and Inland Revenue Authority of Singapore’s (IRAS) regulations by submitting your statutory returns within the specified timeframe after each financial year. We are here to provide you with all the necessary information and support to make the compliance process seamless and hassle-free.

Our guide offers valuable insights into the intricacies of annual compliance for Singapore companies. We cover all the essential information, including required documents, deadlines, and the consequences of non-compliance. By exploring our guide, you will gain a clear understanding of the statutory returns required for your company in Singapore.

Estimated Chargeable Income (ECI) Filing

The first statutory deadline for companies after the financial year ends is the Estimated Chargeable Income (ECI) filing. It is crucial to file your ECI within 3 months from the end of the financial year. ECI is an estimation of taxable income and serves as the basis for tax assessment.

Filing your ECI early and on time comes with significant benefits. For qualifying companies, the earlier the ECI is filed, the greater the number of instalments they can enjoy. At CA.sg, we understand the importance of accurate and timely ECI filing. Our experts can assist you in preparing and filing your ECI on time, ensuring compliance with statutory requirements and maximising benefits.

Trust us with your ECI filing and focus on managing your business operations while we handle your tax obligations. Contact us today for seamless ECI filing services.

Preparation of Financial Statements

Determining whether your company needs to file financial statements is an essential step. If required, your company needs to prepare its financial statements as soon as possible for directors’ approval and submission at the Annual General Meetings.

The financial statements should be prepared in Singapore Financial Reporting Standards (SFRS) format and should minimally include the following:

- Statement of Financial Position: Showcasing your company’s equity, assets, and liabilities.

- Statement of Comprehensive Income: Reflecting your company’s financial performance, including revenue, expenses, gains and losses, and income tax.

- Statement of Cash Flows: Highlighting cash or cash equivalents flowing in and out resulting from operating, investing, and financing activities.

- Statement of Equity Changes: Including transactions with members, changes in share capital, issuance of share classes, and dividends (if applicable).

- Notes detailing significant accounting policies.

It is important to note that not all companies require audited financial statements. Your company may qualify for audit exemption if it meets any two of the following criteria:

- Total annual revenue equal to or less than S$10 million.

- Total assets equal to or less than S$10 million.

- Employing fewer than 50 individuals.

To ensure that your company complies with the requirements without incurring unnecessary costs, it is best to leave it to the professionals who are always updated on the latest requirements and changes.

Reach out to us for assistance with financial statement matters.

Annual General Meeting (AGM)

The AGM must be held within 6 months from the FYE (within 4 months for listed companies). Once the Financial Statement is prepared, it should be presented to the members of the company at the AGM. For most companies, AGM is a mandatory yearly gathering of members to keep them informed about your company’s affairs. During the AGM, your company presents the financial statements for consideration and approval by the members.

For good corporate governance and record keeping, it is crucial to ensure that all transactions and approvals of your company are properly documented in the AGM, as well as other directors’ and members’ meetings.

Contact us today for reliable corporate secretarial services.

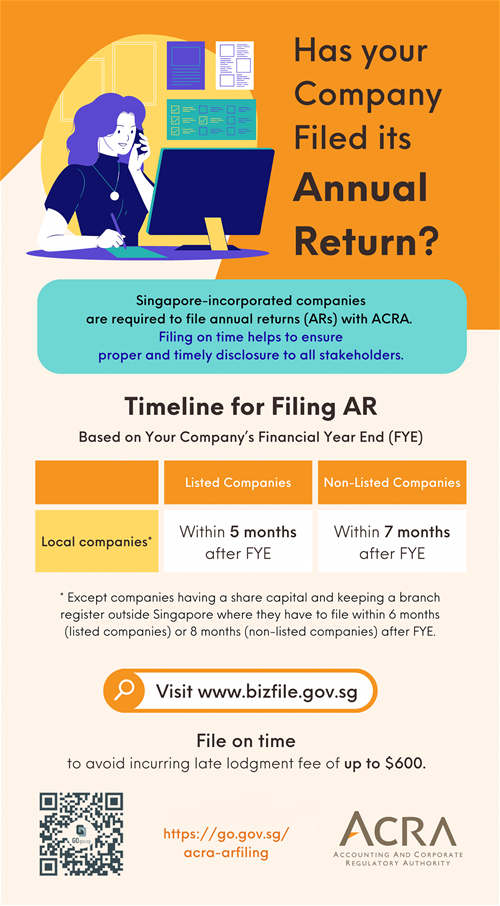

Annual Return Filing

The Annual Return must be held within 7 months from the FYE (within 5 months for listed companies). An annual return is a yearly statement that includes crucial details about your company’s composition, activities, and financial standing. Your company must also submit the date of its AGM if it has held its AGM, as well as the company’s financial statements (if applicable). Company officers may face enforcement action for failing to file their company’s annual return.

Source: ACRA

You can file the annual return through ACRA’s user-friendly online filing portal BizFile+ using the designated officer of your company. Alternatively, you can enlist the services of a registered filing agent like us.

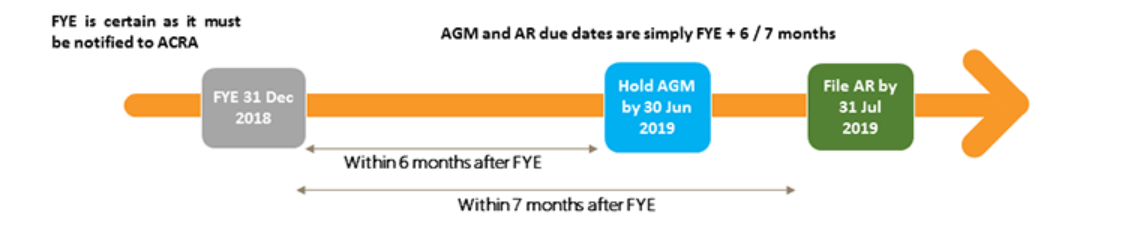

Key Timeline for Annual Return

Private, non-listed Singapore companies must submit their annual return to ACRA within seven months from the end of their financial year-end.

Here’s an illustrative timeline for the holding of AGM and for the filing of AR for private companies with the FYE 31 December 2018:

Failure to comply with the deadline may result in a late lodgement penalty of up to $600 for each delayed submission.

XBRL Implementation

Unless exempted, Singaporean companies must submit their financial statements in XBRL format.

The table below summarises the revisions to the filing requirements and data elements:

| Group | Companies that file FS that are made public | Requirements (mandatory from 1 May 2021) |

|---|---|---|

| 1 | SG-incorporated companies that are not covered in Groups 2 to 5 below. | To file FS in XBRL format, and the extent of XBRL filing varies based on the company’s nature and size of operations:

|

| 2 | SG-incorporated exempt private companies (EPCs) that are insolvent | To file FS in XBRL format, and the extent of XBRL filing varies based on the company’s nature and size of operations:

|

| 3 | SG-incorporated EPCs that are solvent | Not required to file FS. If the company opts to voluntarily file, to file FS in either:

If the company opts to file FS in XBRL format, its extent of XBRL filing will vary based on the same criteria as Groups 1 and 2 |

| 4 | SG-incorporated companies in the business of banking, finance and insurance regulated by MAS | To file FS in:

together with PDF copy of the FS authorised by directors. |

| 5 | SG-incorporated companies preparing FS using accounting standards other than prescribed accounting standards in Singapore or IFRS | To file only PDF copy of the FS authorised by directors. |

| 6 | SG-incorporated companies limited by guarantee | To file only PDF copy of the FS authorised by directors |

| 7 | Foreign companies with SG branches | To file only PDF copy of the FS authorised by directors |

Discover our incredible starting fee of just $400!

Corporate Income Tax (CIT)

With the exception of dormant companies, you must still file your Income Tax Return (Form C-S/Form C) with the IRAS, along with any supporting documents (e.g. financial statements and tax computation) by 30 November annually.

Failure to comply with the deadlines and requirements could be very costly. Apart from losing the benefits of interest free instalments, you may also be required to pay interests and fines on the outstanding tax payables.

Registers of Registrable Controllers, Register of Nominee Directors, and Register of Nominee Shareholders

Singapore companies must maintain Register of Registrable Controllers, Register of Nominee Directors, and Register of Nominee Shareholders to ensure transparency and compliance with corporate governance regulations.

The Register of Registrable Controllers contains information about individuals or entities with significant control or influence over the company.

The Register of Nominee Directors documents details of individuals acting as nominees on behalf of others.

The Register of Nominee Shareholders records particulars of individuals or entities holding shares on behalf of others.

The deadlines for updating changes with ACRA can be as short as 2 days. Failing to comply with these requirements can result in penalties of up to $5,000.

At CA.sg, we pride ourselves on our responsiveness, accuracy, and timeliness. Our dedicated team of experts understands the complexities and time-sensitive nature of these compliance requirements. We go above and beyond to streamline your compliance process, allowing you to focus on your core business activities without worries.

Don’t let the fear of breaching compliance requirements or the complexities of annual return filing overwhelm you. With our proven track record and expertise, you can confidently entrust us with the preparation and filing of your financial statements and XBRL requirements. We guarantee accurate and timely submissions, ensuring that you meet all regulatory deadlines.

Reach out to us!

Navigating the compliance requirements for Singapore companies can be challenging, but with the right support and guidance, you can ensure seamless adherence to all statutory obligations. At CA.sg, we specialise in providing comprehensive compliance services tailored to your company’s needs. From ECI filing and financial statement preparation to AGM and annual return filing, we have the expertise to handle it all.

Don’t let the compliance burden weigh you down. Let us take care of your compliance needs while you focus on growing your business. Contact us today to get started.